Chapter 10.1 The Federal Reserve Banking System

10.1 The Federal Reserve Banking System and Central Banks

Learning Objectives

By the end of this section, you will be able to:

- Explain the structure and organization of the U.S. Federal Reserve: Board of Governors, 12 Federal Reserve Bank Districts and the FOMC

The Central Bank is an organization responsible for conducting monetary policy and ensuring that a nation’s financial system operates smoothly. Most nations have central banks. Some prominent central banks around the world include the European Central Bank, the Bank of Japan, and the Bank of England. In the United States, we call the central bank the Federal Reserve—often abbreviated as just “the Fed.” This section explains the U.S. Federal Reserve’s organization and identifies the major central bank’s responsibilities.

The Federal Reserve was established in 1913. However, significant reforms were implemented following the Great Depression to prevent bank runs and to mitigate the cyclicality of the business cycle, particularly the pattern of recession and recovery.

A central bank makes decisions about the money supply and whether to raise or lower interest rates. In this way, to the Central Bank influence macroeconomic policy with the goal of fostering low unemployment and low inflation. The central bank is also responsible for regulating all or part of the nation’s banking system to protect bank depositors and insure the health of the bank’s balance sheet.

Structure and Organization of the Federal Reserve

Board of Governors

The Fed is run by the Board of Governors, which consist of seven members, each appointed for 14 years by the US President and confirmed by the Senate. The chair of the fed is also appointed by the President for a four-year term.

Unlike most central banks, the Federal Reserve is semi-decentralized, mixing government appointees with representation from private-sector banks. Each member of the Board of Governor are appointed for a 14-year terms, and they are arranged so that one term expires January 31 of every even-numbered year. The purpose of the long and staggered terms is to insulate the Board of Governors as much as possible from political pressure so that governors can make policy decisions based only on their economic merits. Additionally, except when filling an unfinished term, each member only serves one term, further insulating decision-making from politics. The Fed’s policy decisions do not require congressional approval, and the President cannot ask for a Federal Reserve Governor to resign as the President can with cabinet positions.

One member of the Board of Governors is designated as the Chair. Jerome Powell was nominated as the Chair of the Federal Reserve by President Donald Trump. He was nominated in November 2017 and confirmed by the Senate in January 2018.

Clear It Up

Who has the most immediate economic power in the world?

(Credit: “_NZ79221” by Board of Governors of the Federal Reserve System/Flickr, Public Domain)

Figure 10.1 Chair of the Federal Reserve Board Jerome H. Powell (Credit: “_NZ79221” by Board of Governors of the Federal Reserve System/Flickr, Public Domain)

The Fed Chair is first among equals on the Board of Governors. While they have only one vote, the Chair controls the agenda, and is the Fed’s public voice, so they have more power and influence than one might expect.

12 Federal Reserve Districts

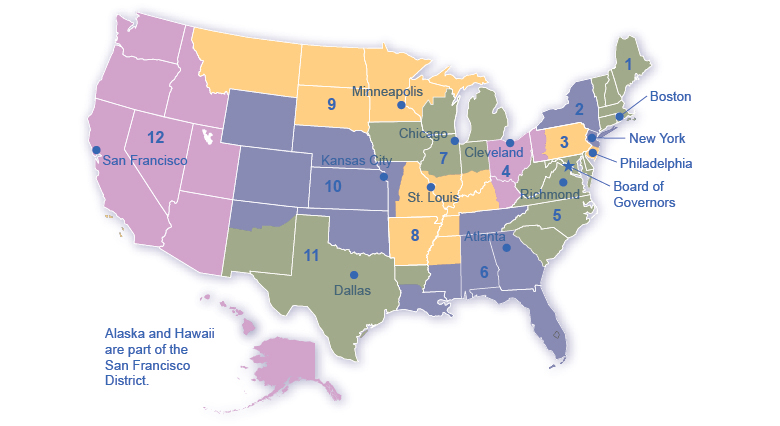

The Fed also includes 12 regional Federal Reserve banks, each of which is responsible for supporting the commercial banks and economy generally in its district. Figure 12.2 shows the Federal Reserve districts and the cities where their regional headquarters are located. The commercial banks in each district elect a Board of Directors for each regional Federal Reserve bank, and that board chooses a president for each regional Federal Reserve district. Thus, the Federal Reserve System includes both federally and private-sector appointed leaders.

“The Twelve Federal Reserve Districts” by OpenStax, is licensed under CC BY 4.0

Figure 10.2 The Twelve Federal Reserve Districts There are twelve regional Federal Reserve banks, each with its district.

Federal Open Market Committee

US monetary policy is formally set by the Federal Open Market Committee (FOMC). The FOMC comprises seven members of the Federal Reserve’s Board of Governors. It also includes five voting members who the Board draws, on a rotating basis, from the regional Federal Reserve Banks. The New York district president is a permanent FOMC voting member and the Board fills other four spots on a rotating, annual basis, from the other 11 districts. The FOMC typically meets every six weeks, but it can meet more frequently if necessary. The FOMC tries to act by consensus; however, the Federal Reserve’s chairman has traditionally played a very powerful role in defining and shaping that consensus. The FOMC set goals concerning the money supply and interest rates and it directs the Open Market desk to buy or sell government securities. We will discuss this in more detail in section 12.3, Monetary Policy.

This chapter is a revised version of the chapter 15.1 The Federal Reserve Banking System and Central Banks in Principles of Macroeconomics 3e by OpenStax, published under a Creative Commons Attribution 4.0 International License. Other additions and modifications have been made in accord with the style, structure, and audience of this guide.