Chapter 4.3: The Business Cycle

4.3 Business Cycle

Learning Objectives

By the end of this section, you will be able to:

- Define what is a business cycle

- Explain recessions, depressions, peaks, and troughs

- Evaluate the importance of tracking real Gross Domestic Product GDP over time

Business Cycle

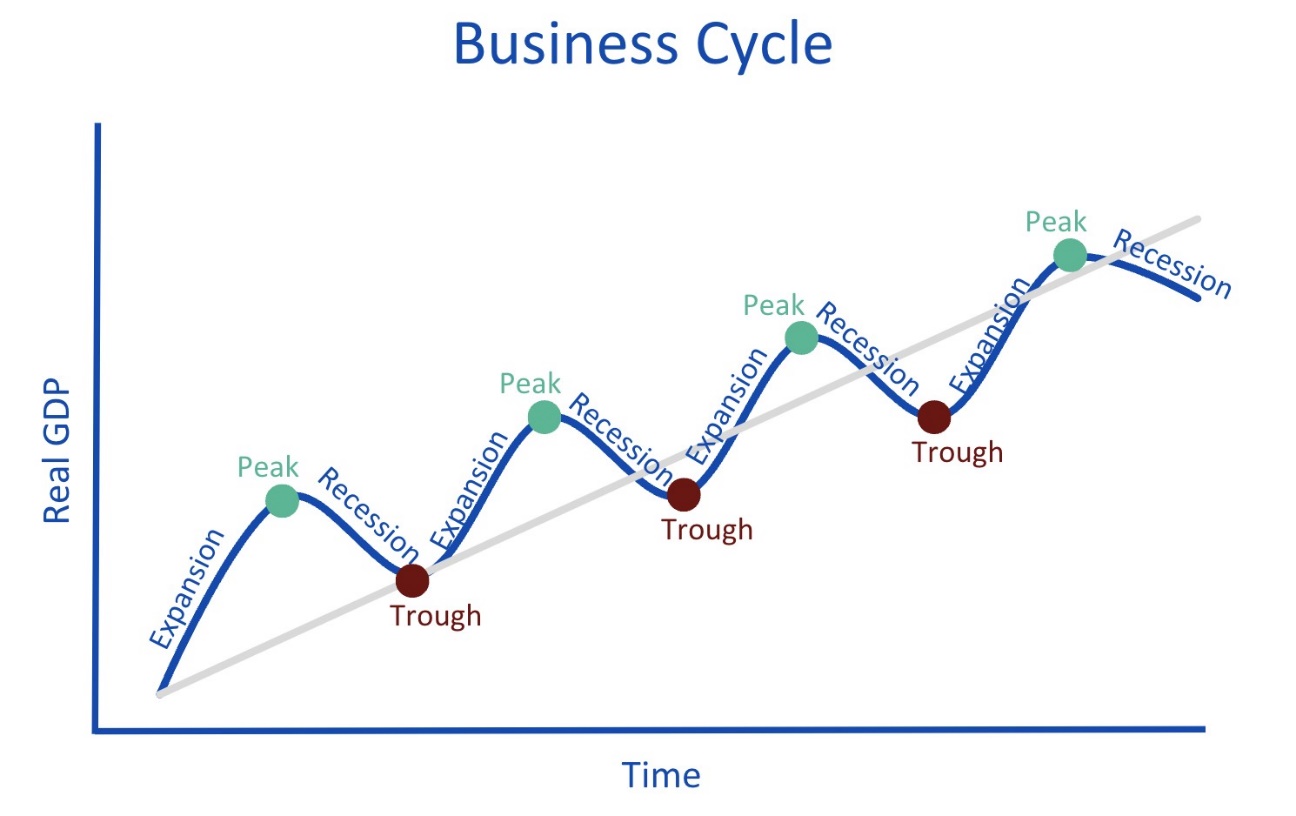

A Business Cycle is the ups and down of an economy. GDP tends to fluctuate by expanding and contracting and then expanding again. Periods of expansion usually can last 10 years or more, and periods of contraction, tend to be short 1 or 2 years. The long-term trend tend to be growth. See Figure 6.5

Figure 4.6 Business Cycle

Peak – during the business cycle, the highest point of output before a recession begins.

Trough – during the business cycle, the lowest point of output in a recession, before a recovery begins.

The Bureau of Economic Analysis (BEA) releases GDP data annually and quarterly

4 quarters in a year

Q1: Jan- Mar

Q2: Apr-Jun

Q3: Jul-Sep

Q4: Oct-Dec

A recession is a period when the economy contracts during two consecutive quarters.

Question: When did the recession start in the below example?

|

|

Year 1 |

Year 2 |

Year 3 |

|

Q1 |

1% |

2% |

-0.3% |

|

Q2 |

0.2% |

1% |

-0.4% |

|

Q3 |

-0.5% |

0.05% |

-0.9% |

|

Q4 |

0.3% |

-0.7% |

1% |

Answer: during the 4th quarter of year 2.

When news reports indicate that “the economy grew 1.2% in the first quarter,” such reports are referring to the percentage change in real GDP. By convention, governments report GDP growth at an annualized rate: Whatever the calculated growth in real GDP was for the quarter, we multiply it by four when it is reported as if the economy were growing at that rate for a full year.

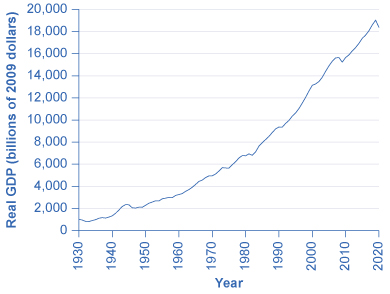

“U.S. GDP, 1930–2020” by OpenStax, is licensed under CC BY 4.0

Figure 4.6 U.S. GDP, 1930–2020 Real GDP in the United States in 2020 (in 2012 dollars) was about $18.4 trillion. After adjusting to remove the effects of inflation, this represents a roughly 20-fold increase in the economy’s production of goods and services since 1930. (Source: bea.gov)

Figure 4.6 shows the pattern of U.S. real GDP since 1930. Short term declines have regularly interrupted the generally upward long-term path of GDP. We call a significant decline in real GDP a recession. We call an especially lengthy and deep recession a depression. The severe drop in GDP that occurred during the 1930s Great Depression is clearly visible in the figure, as is the 2008–2009 Great Recession and the recession induced by COVID-19 in 2020.

Real GDP is important because it is highly correlated with other measures of economic activity, like employment and unemployment. When real GDP rises, so does employment.

The most significant human problem associated with recessions (and their larger, uglier cousins, depressions) is that a slowdown in production means that firms need to lay off or fire some of their workers. Losing a job imposes painful financial and personal costs on workers, and often on their extended families as well. In addition, even those who keep their jobs are likely to find that wage raises are scanty at best—or their employers may ask them to take pay cuts.

Table 4.5 lists the pattern of recessions and expansions in the U.S. economy since 1900. We call the highest point of the economy, before the recession begins, the peak. Conversely, the lowest point of a recession, before a recovery begins, is the trough. Thus, a recession lasts from peak to trough, and an economic upswing runs from trough to peak. We call the economy’s movement from peak to trough and trough to peak the business cycle. It is intriguing to notice that the three longest trough-to-peak expansions of the twentieth century have happened since 1960. The most recent recession was caused by the COVID-19 pandemic. It started in February 2020 and ended formally in May 2020. This was the most severe recession since the 1930s Great Depression, but also the shortest. The previous recession, called the Great Recession, was also very severe and lasted about 18 months. The expansion starting in June 2009, the trough from the Great Recession, was the longest on record—ending 128 months with the pandemic-induced recession.

|

Trough |

Peak |

Months of Contraction |

Months of Expansion |

|

December 1900 |

September 1902 |

18 |

21 |

|

August 1904 |

May 1907 |

23 |

33 |

|

June 1908 |

January 1910 |

13 |

19 |

|

January 1912 |

January 1913 |

24 |

12 |

|

December 1914 |

August 1918 |

23 |

44 |

|

March 1919 |

January 1920 |

7 |

10 |

|

July 1921 |

May 1923 |

18 |

22 |

|

July 1924 |

October 1926 |

14 |

27 |

|

November 1927 |

August 1929 |

23 |

21 |

|

March 1933 |

May 1937 |

43 |

50 |

|

June 1938 |

February 1945 |

13 |

80 |

|

October 1945 |

November 1948 |

8 |

37 |

|

October 1949 |

July 1953 |

11 |

45 |

|

May 1954 |

August 1957 |

10 |

39 |

|

April 1958 |

April 1960 |

8 |

24 |

|

February 1961 |

December 1969 |

10 |

106 |

|

November 1970 |

November 1973 |

11 |

36 |

|

March 1975 |

January 1980 |

16 |

58 |

|

July 1980 |

July 1981 |

6 |

12 |

|

November 1982 |

July 1990 |

16 |

92 |

|

March 1991 |

March 2001 |

8 |

120 |

|

November 2001 |

December 2007 |

8 |

73 |

|

January 2009 |

February 2020 |

2 |

128 |

|

April 2020 |

TBD |

TBD |

TBD |

“U.S. Business Cycles since 1900” by OpenStax, is licensed under CC BY 4.0

Table 4.5 U.S. Business Cycles since 1900 (Source: http://www.nber.org/cycles/main.html)

A private think tank, the National Bureau of Economic Research (NBER), tracks business cycles for the U.S. economy. However, the effects of a severe recession often linger after the official ending date assigned by the NBER.

This chapter is a revised version of chapter 6.3 Tracking Real GDP over Time in Principles of Macroeconomics 3e by OpenStax, published under a Creative Commons Attribution 4.0 International License. Other additions and modifications have been made in accord with the style, structure, and audience of this guide.