12 U.S. Income Taxes*

If you’ve never filed income taxes before or if you’ve lived in another country, the United States income tax system likely seems confusing and complex. Plus, the responsibility is on you—the individual taxpayer—to figure out your tax, unlike some countries where the government figures out your tax (Reid, 2017). Read on to learn the basics of the U.S. tax system and how to file and pay—or get a refund—on your taxes.

Overview

Any government that needs to raise revenue and has the legal authority to do so may tax. Tax jurisdictions reflect government authorities. In the United States, federal, state, and municipal governments impose taxes. Similarly, in many countries there are national, provincial or state, county, and municipal taxes.

Jurisdictions may overlap. For example, in the United States, federal, state, and local governments may tax income, which becomes complicated for those earning income in more than one state, or living in one state and working in another.

Governments tax income because it is a way to tax broadly based on the ability to pay. Most adults have an income from some source, even if it is a government distribution. Those with higher incomes should be able to pay more taxes, and in theory should be willing to do so, for they have been more successful in or have benefited more from the economy that the government protects.

Taxes are law. Federal tax law is written by the U.S. Congress and enforced by the Internal Revenue Service (IRS), which is a part of the U.S. Department of the Treasury. The IRS is responsible for the collection of taxes. To collect tax revenues, the IRS has to figure out how to inform people about meeting their income tax obligations while also collecting enough information to be able to check that those taxes are correct.

The tax code changes frequently. Some changes are annual adjustments to tax brackets or standard deductions while others are a result of tax-related laws passed by Congress. Taxpayers should expect some changes every year to their taxes.

Learn how tax dollars are spent in this video:

Tax is levied on income from many sources:

- Wages (selling labor)

- Interest, dividends, and gains from investment, including selling cryptocurrency (selling capital)

- Self-employment, including gig work, operating a business, or selling a good or service

- Property rental

- Royalties (rental of intellectual property)

- “Other” income such as alimony, gambling winnings, or prizes

Income tax is usually a progressive tax: the higher the income or the more money to be taxed, the greater the tax rate. The percentage of income that is paid in tax increases as income rises leading to what are called “tax brackets” in the U.S. income tax code. Tax brackets are an often misunderstood aspect of our income tax system, yet they are vital to understanding how additional income can affect the taxes you pay.

In the video below, learn about tax brackets and how they really work:

View tax brackets and their tax rates for the most recent tax filing year.

Filing and Paying Federal Taxes

Who Needs to File

An IRS online tool can help you determine if you need to file federal income taxes. You may not have to file if your income is below a certain amount. However, you must file a tax return to claim a refundable tax credit or a refund on income tax withheld. You have up to three years to file a tax return claiming a refund or you lose it.

The video below discusses the three years you have to file a tax return claiming a refund or lose it:

International Students and Taxes

International students temporarily present in the United States are subject to special rules with respect to the taxation of their income.

- Any amount of income from work in the United States requires nonresident foreign students to file a tax return using Form 1040-NR.

- Scholarships or grants can sometimes be taxable as described in Chapter 1 of Publication 970, Tax Benefits for Education. If students have taxable scholarships, they can report it on the Form 1040-NR tax return.

- All nonresident foreign students must file Form 8843 each year that they are in the U.S. even if they do not have to file the 1040-NR.

Refer to Foreign students, scholars, teachers, researchers and exchange visitors for more information. All forms can be printed from the IRS website and additional publications can be found there that may be necessary depending on the individual student’s circumstances.

How to File

Taxpayers declare income and show their obligations to the government by filing Form 1040 with the IRS.

Steps to file your federal tax return:

- You will need the forms and receipts that show the money you earned and the tax-deductible expenses you paid.

These include:

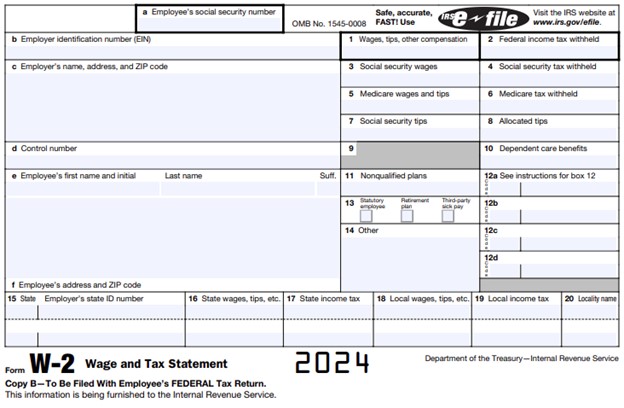

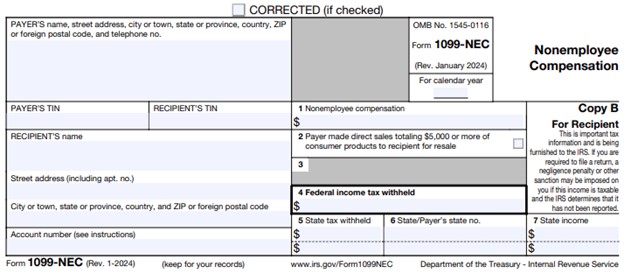

- A W-2 form from each employer or other earning and interest statements (1099 forms). Learn about the differences between W-2 and 1099 employees.

- If you are itemizing your return, receipts for: charitable donations; mortgage interest; state and local taxes; medical and business costs; and other tax-deductible expenses.

- Choose your filing status.

Filing status is based on whether you are married or have dependents. The percentage you pay toward household expenses can also affect your filing status.

- Decide how you want to file your taxes.

- You may be able to file free online through the IRS Direct File program if you are in New York (or one of the other 23 participating states) and have a simple tax return. If IRS Direct file is not an option for you, there are other ways to file a return.

- Note that the IRS recommends using tax preparation software to e-file for the easiest and most accurate returns and fastest refunds. If you file by mail, it can take four weeks or more for the IRS to process your return.

- Determine if you are taking the standard deduction or itemizing deductions on your tax return.

A deduction is an amount you subtract from your income when you file so that you don’t pay tax on it. Choosing the standard deduction or itemizing deductions generally depends on your filing status and the total amount of your allowable itemized deductions (Weida, 2025).

- If you owe money, choose how you will make your payment.

Learn how to make a tax payment online or by cash, check, or money order and where to send it. You can also set up a payment plan.

- Submit your return by the filing deadline.

The filing and payment due date for most taxpayers is April 15 for income earned the previous calendar year (Meyer, 2025). If you’re unable to file on time, you can request an extension to file your tax return, but you still have to pay by April 15 what you estimate that you owe.

Main Sections of the Income Tax Return

Income = Money Coming In

You will receive forms such as the W-2 or 1099-NEC reporting how much you’ve been paid for work.

As a student, you may have also received a Pell Grant or scholarship—that’s also money coming in, although you may have spent it right away on your college tuition. Are those taxable? If used for “qualified educational expenses” (as defined by the IRS), then grants and scholarships are not usually taxable, but there are instances where some of that money could be taxable. Learn more about when scholarships and grants might be taxable (Taylor, 2023).

Credits and Deductions Reduce Taxes

Both credits and deductions lower your taxes, but they work in very different ways. Read a quick overview of the differences. (Orem, 2023) Always check current guidelines for the latest on any limits and eligibility for specific credits and deductions.

Some common credits:

- Earned Income Tax Credit (EITC): helps low- to moderate-income workers and families get a tax break. If you qualify, you can use the credit to reduce the taxes you owe – and maybe increase your refund.

- American Opportunity Tax Credit (AOTC): a credit for qualified education expenses paid for an eligible student for the first four years of higher education with a maximum annual credit of $2,500 per eligible student.

- Lifetime Learning Credit (LLC): The lifetime learning credit (LLC) is for qualified tuition and related expenses paid for eligible students enrolled in an eligible educational institution. There is no limit on the number of years you can claim the credit. It is worth up to $2,000 per tax return.

See the chart below to learn more about the difference between the AOTC and LLC educational tax credits and which you may be eligible for.

No double benefits–note that you can’t take more than one education benefit for the same student and the same expenses. So, you can’t take the AOTC and the LLC for the same student in the same tax year. Also, if you receive tax-free educational assistance, such as a grant, you need to subtract that amount from your qualified education expenses.

Tax Year 2024 Education Tax Credits Comparison

| Criteria | AOTC | LLC |

| Maximum benefit | Up to $2,500 credit per eligible student | Up to $2,000 credit per tax return |

| Refundable or nonrefundable | 40% of credit (refundable) | Not refundable |

| Limit on MAGI [modified adjusted gross income] for married filing jointly / single, head of household, or qualifying widow(er) | $180,000 / $90,000 | $180,000 / $90,000 |

| -Dependent status | Cannot claim benefit if someone else can claim you as a dependent on their return | |

| Can you or your spouse be a nonresident alien? | No, unless nonresident alien is treated as resident alien for tax purposes (see Publication 519 for information on nonresident alien status) | |

| Number of years of post-secondary education available | Only if student hasn’t completed 4 years of post-secondary education before 2024 | All years of post-secondary education and for courses to acquire or improve job skills |

| Number of tax years benefit available | 4 tax years per eligible student (includes any years former Hope credit claimed) | Unlimited |

| Type of program required | Student must be pursuing a degree or other recognized education credential | Student does not need to be pursuing a degree or other recognized education credential |

| Number of courses | Student must be enrolled at least half time for at least one academic period beginning in 2024 | Available for one or more courses |

| Qualified expenses | Tuition, required enrollment fees and course materials needed for course of study | Tuition and fees required for enrollment or attendance |

| For whom can you claim the benefit? | * You

* Your spouse * Student you claim as a dependent on your return |

|

| Payments for academic periods | Made in 2024 for academic periods beginning in 2024 or the first 3 months of 2025 | |

| Do I need to claim the benefit on a schedule or form? | Yes, Schedule 3 of Form 1040 PDF and Form 8863, Education Credits PDF |

You should receive a 1098-T from your school showing the qualified educational expenses paid for the year. You will need the 1098-T form to help you figure out your AOTC or LLC tax credits (Berry-Johnson, 2024).

Examples of other deductions

You can deduct these expenses whether you take the standard deduction or itemize:

- Alimony payments

- Self-employment expenses

- Money you put in an IRA or health savings account

- Student loan interest

- For some military, government, self-employed, and people with disabilities: work-related education expenses

If you itemize, you can deduct these expenses:

- Home mortgage interest

- Medical and dental expenses over 7.5% of your adjusted gross income

- State, local, and foreign income taxes OR state and local sales taxes

- Loss on the sale of stocks, mutual funds, or other capital assets

- Donations to charity

- Losses from disasters and theft

State and Local Taxes

Don’t forget to file state income taxes if you live in one of the 43 states or Washington, D.C. that tax some or all forms of income (Yushkov, 2024). For example, New York State residents will also need to file state taxes, and if they live in New York City or Yonkers, local taxes. Self-employed individuals earning over $50,000 from work in the New York Metropolitan area may also owe additional tax. All these taxes are filed on the same form as the New York State tax (New York State Dept. of Taxation and Finance, 2023).

Tax Scams

Unfortunately, scams involving taxes and impersonation of the IRS are all too common. Criminals pretending to represent the IRS try to convince unwary people into sending them money for taxes or tax penalties.

Check out this video about the common scams involving federal taxes and the IRS:

Key Takeaways

- Even if you are not required to file a tax return, you need to file if you want to claim any refund owed to you from excess withholding or refundable tax credits.

- Income includes more than wages or salary. It also includes earnings from the gig economy, such as selling goods online, as well as interest, dividends, and capital gains including sales of cryptocurrency.

- Scholarships are not usually considered income but only if spent on what the IRS lists as “qualified educational expenses.”

- Students should know about the different credits for spending on education that can save money for them at tax time.

* Combined and adapted from Chapter 6 in the book Individual Finance by R. S. Siegel and C. Yacht under a CC BY-NC-SA 3.0 license, Internal Revenue Service web content (Public Domain), the IRSvideos site (Public Domain), and the Taxes section of the USAGov website (Public Domain) unless otherwise indicated.

Test Your Knowledge

Please Provide Feedback

What is one tip that you learned from this chapter?

References

Berry-Johnson, J. (2024). What should college students know about Form 1098-T? Credit Karma. https://www.creditkarma.com/tax/i/form-1098t-for-college-students

Meyer, M. (2025, February 1). Tax season 2025 is underway: Here’s every important date and deadline to know. CNET. https://www.cnet.com/personal-finance/taxes/tax-season-2025-is-underway-heres-every-important-date-and-deadline-to-know/

New York State Department of Taxation and Finance. (2023, November 28). New York City, Yonkers, and MCTMT. https://www.tax.ny.gov/pit/file/nyc_yonkers_residents.htm

Orem, T. (2023, November 9). Tax credit vs. tax deduction. NerdWallet. https://www.nerdwallet.com/article/taxes/tax-credit-vs-tax-deduction

Reid, T. R. (2017, April 13). Dreading doing your taxes? Other countries show us there’s another way [Video transcript of interview with P. Solman]. PBS News Hour. https://www.pbs.org/newshour/show/dreading-taxes-countries-show-us-theres-another-way

Taylor, K. R. (2023, May 2). Are scholarships always tax-free? What you need to know. Kiplinger Personal Finance. https://www.kiplinger.com/taxes/are-scholarships-tax-free

Weida, K. (2025, January 14). Standard deduction vs. itemized: How to decide which tax filing approach is right. Yahoo Finance. https://finance.yahoo.com/personal-finance/taxes/article/standard-deduction-vs-itemized-210300533.html?guccounter=2

Yushkov, A. (2024, February 20). State individual income tax rates and brackets, 2024. Tax Foundation. https://taxfoundation.org/data/all/state/state-income-tax-rates-2024/