9 Alternative Investments*

Learning Objectives

- Define and describe the characteristics of investment alternatives such as cryptocurrency, real estate, collectibles, gold and precious metals, and commodities and commodity futures.

- Understand the characteristics of these alternatives that make them speculative as investments.

Cryptocurrency

You can hardly go online or catch the news today without hearing about cryptocurrency. While there are various definitions of cryptocurrency, here are some characteristics that they have in common:

- They are digital or virtual money that is issued in units called “coins” or “tokens.”

- Coins are created and processed using encryption for security and verification.

- Cryptocurrencies are decentralized, meaning no single person or group has control.

- Most were created to operate outside of governmental oversight; however, this aspect is now being questioned as more and more people own cryptocurrency and, thus, are exposed to its risks. (Hayes, 2023)

Bitcoin is the most widely held cryptocurrency in the world. Watch this short video for background on how Bitcoin and the blockchain work.

Pro and Cons of Bitcoin (and many other cryptocurrencies)**

Not surprisingly, this relatively newer form of currency has experienced some twists and turns as it has developed, showing us both its positive and negative effects. The bitcoin pros and cons that follow generally apply to other cryptocurrencies as well.

PROs

- Transparency: All Bitcoin transactions are public, traceable, and permanently stored in the Bitcoin blockchain network. Anyone can see the balance and all transactions of any address on this public ledger.

- Decentralized, peer-to-peer: The blockchain functions in a decentralized way so that no single person or group has control—rather, all users retain control collectively.

- Potential for privacy: Traditional banking requires proof of identity while Bitcoin uses pseudonyms (more specifically, your wallet address) to execute transactions, giving users the ability to send money without giving identifying information. However, because all transactions are public, if someone figures out your unique pseudonym, they can also see your transactions.

- Accessibility and liquidity: Bitcoin provides global accessibility. It allows any business or individual to send and receive payments securely anywhere at any time, with or without a bank account.

CONs

- Volatility: Driving bitcoin’s large price fluctuations are supply and demand: Bitcoin’s market price is affected by how many coins are in circulation and how much people are willing to pay. Speculation about future ups and downs in Bitcoin’s price is driven by fear and greed and exploited by social media “experts.” (Reiff, 2024)

- No government regulation: Many crypto enthusiasts believe having no government regulation is a PRO. It sets cryptocurrency apart from the traditional financial sector and banking world; however, this absence of regulation may soon change as lawmakers and regulatory agencies around the world consider taking action. The lack of regulation also means that there is no equivalent to Federal Deposit Insurance Corporation (FDIC) insurance that covers traditional bank accounts in case of bank failure. Cryptocurrency exchanges are not banks and carry no such guarantee.

- Irreversible: Unlike traditional bank transactions, Bitcoin does not allow transaction reversibility, also known as “chargebacks.” In situations where you’ve accidentally sent funds to an incorrect unknown Bitcoin address, it is nearly impossible to recover your funds. If your assets are stolen, you’re out of luck!

- Limited use and lack of scalability: There is limited capacity on the Bitcoin blockchain network to handle large amounts of transaction data in a short span of time. Increasing trade volume causes a backlog which limits Bitcoin use because if we all transacted in Bitcoin daily, it would cause massive congestion on the network and fees would spike. Many experts, therefore, no longer view Bitcoin as a currency but more as a speculative, or highly risky, investment.

- Harm to the environment: The Bitcoin network uses astonishing amounts of electricity. Bitcoin miners require highly specialized machines to perform complex math calculations quickly and enough cooling power to keep the constantly running hardware from overheating. The process of creating Bitcoin consumes more electricity annually than all of Argentina!

But Bitcoin is not the only cryptocurrency out there. As of January 2025, there were 10,567 different cryptocurrencies worldwide (Statista, 2025).

Watch a video on altcoins from the article, “10 Important Cryptocurrencies Other Than Bitcoin” (Hayes, 2023).

Cryptocurrency values can swing largely and quickly, which can make it frustrating to use crypto to make purchases. Let’s say that your favorite taco meal deal is selling for $5. If you’re paying with U.S. dollars, it does not matter if you buy the taco deal on Monday or Thursday—it will cost $5. But if you could also purchase the meal deal using Bitcoin or Ethereum (another cryptocurrency) you would not know how much it would cost. For example, if there existed a cryptocurrency of which two coins cost $5 today, then you could buy the taco meal deal for two of those coins today. But due to fluctuations in the price of most digital currencies, that same taco deal might cost you 2.42 coins (= $6.05) three days later and 1.90 coins (= $4.75) a week later … and you might not know the price until it came time to pay. Learn about many of the factors that influence the price of Bitcoin, the world’s most popular cryptocurrency.

Finally, keep in mind that the world of cryptocurrency moves quickly. Within the 12 months leading up to the update of this chapter in January 2025, the CEO of the major cryptocurrency exchange FTX was sentenced to 25 years in prison for fraud while his customers lost out on Bitcoin price gains. The customers’ cryptocurrency funds held at FTX were frozen for over two years during the bankruptcy proceedings and investigation. (Torpey, 2024) Other fraudulent and illegal activities in the crypto space during this time included rug pulls, airdrops, counterfeiting, and impersonation (Cointelegraph, 2024). As an investor, it’s up to you to do your research and keep up with developments. The Wall Street Journal and The New York Times are valuable sources of up-to-date information; some colleges offer their students and faculty free online subscriptions: check with your library.

Activity

How much do you know about cryptocurrency? Take the Crypto Literacy Quiz to see how much you know about crypto. In 2024, only 57% of quiz takers passed this basic quiz.

Real Estate***

When you buy a home, even with a mortgage, you are making a direct investment, because you are both the investor and the owner who holds legal title to the property. For most people, a home is the single largest investment they ever make.

As an investor, you may also want to include other real estate holdings in your portfolio, most likely as an indirect investment in which you invest in an entity that owns and manages real estate.

Direct Investments

Sonia is looking to buy her first home. After graduating from college, she decided to stay in the area because she liked the town and found a job as an elementary school teacher. She loves her job, but her income is limited. She finds a nice, two-family house in a neighborhood close to the college. It needs some work, but she figures she can use the summer months to fix it up—she’s pretty handy—and renting to students won’t be a problem. The tenants will pay their own utilities. Sonia figures that the rental income will help pay her mortgage, insurance, and taxes, and that after the mortgage is paid off, it will provide a nice extra income.

Who doesn’t want a bargain? If you are handy with home repair and maintenance, a fixer-upper might just be the best way to begin building your real estate empire. Concentrate on smaller properties first. One strategy is to buy a duplex or triplex and live in one of the units. That way, you will know if any tenants are having wild parties at 2:00 a.m. This is an example of direct investment—you buy the house (the investment). You own the real estate directly.

Depending on where you’re looking to buy, you may be able to find low down payments and seller financing of rundown properties—the seller may want to rid themselves of the chore of being a landlord. Use the services of a competent real estate attorney to ensure that all the documentation is correct. One issue with rundown properties is that banks and credit unions usually do not want to loan to distressed properties; however, banks and credit unions can be more motivated to finance a rundown property that the bank had to foreclose on and is now stuck owning. In any event, do not expect your sojourn into flipping homes to be anything like the reality television shows.

You’ll also need to consider whether or not to hire a property manager. Some investors may want to take advantage of the services of a competent and reputable property manager, but the hard truth is that nobody cares about your property as much as you do, and fees for a property management firm can run to 10%, or more, of the rent. Keep in mind, though, that landlords must be savvy in dealing with toilets and dealing with tenants. If you are not handy dealing with both, then a property management firm might be worth the expense.

Many real estate investors begin like Sonia, buying a rental property that helps them to afford their own home. If you actively manage the rental property, there are tax benefits as well. Of course, you have to provide maintenance services and arrange for repairs, and, in Sonia’s case, perhaps give up a bit of privacy.

For typical homeowners, their home is their major asset. A home can offer a hedge against inflation and functions as one piece of your overall diversified investment portfolio, assuming that you are investing in stocks and bonds through individual choices or mutual funds. Traditionally, a home produces an after-inflation return of about 2.5 percent a year although in some areas, the return has been much higher. There are also generous tax benefits for homeowners, such as the ability to itemize certain home-related deductions on your yearly income tax returns. However, some financial experts take the perspective that a house is your home first and an investment second.

Indirect Investments

Investors who want to add a real estate investment to their portfolio more often make an indirect investment. That is, they buy shares in an entity or group that owns and manages property.

A common form of indirect investing is a real estate investment trust (REIT)—a mutual fund of real estate holdings. You buy shares in the REIT, which may be privately held or publicly traded on an exchange similar to a mutual fund or ETF. The REIT is a fund invested in various commercial properties. Some REITs specialize, concentrating their investments in specific kinds of property, such as shopping malls, apartments, or vacation properties. REITs do for real estate what mutual funds do for other assets. They provide investors with a way to invest with more liquidity and diversity and with comparatively lower transaction costs.

Summary of Direct vs. Indirect Real Estate Investment

| Direct | Indirect | |

| Do you own the property? | Yes. Welcome to the world of home ownership! | No |

| How can you get money for your investment? | Obtain a mortgage (but may be more difficult for fixer-upper houses) | Fund it with money saved for that purpose |

| Can you live in your investment? | Yes | No |

| Can you rent out your investment? | Yes, you are the landlord | No |

| How can you make money (income) from your investment? | Price appreciation when you sell the house. Also, monthly rent if you’re also a landlord | Price appreciation when you sell shares. Also, REITs pay out regular dividends. |

| What ongoing expenses do you have? | Repairs, insurance, property taxes. Also mortgage interest, private mortgage insurance, and property management fees for rentals, as applicable | Taxes on dividends, REIT management fees |

| What are the tax advantages of this type of property ownership? | Several tax deductions and credits may be available to reduce your tax burden. | Possibility of lower tax rate on dividends and capital gains on sale of shares for a profit |

| How liquid (easy to sell) is this investment? | Often not liquid — selling a house sometimes takes a long time | Usually liquid |

Collectibles and Unique Investments

Original photo by Mark Mysoe and licensed under the Creative Commons Attribution-ShareAlike 3.0 License (CC BY-SA)

Any asset that is tradable may become an investment; that is, it may be purchased and held with the expectation that it can be sold when its value increases. So long as there is a market for it—a buyer—it potentially may be sold at a gain.

Examples of collectibles and unique investments include:

- Sports trading cards and memorabilia

- Rare books

- Vintage clothes

- Sneakers

- Vintage vinyl

- Antiques

- Fine art

- Musical instruments

- Jewelry

- Historical curios

As investments, collectibles cannot be standardized in the way that stocks, bonds, or even real estate and used cars can. Each asset has attributes that make it more or less valuable, even among similar assets. Its value is hard to judge, and therefore it is harder for buyer and seller to agree on a price.

Individual investors can consult books on collectibles and may purchase professional market research, pricing indexes, and auction records. Professional appraisers are knowledgeable about both the item and the market and are trained to evaluate such assets. Theirs is a better-educated guess, but it is still just an estimate of value.

Sometimes one person’s trash is another person’s treasure. It is fun to think that you may unearth a rare “find” at a garage sale or flea market or that some family heirloom has more than sentimental value. Usually, however, your ability to cash in on your luck is limited by your ability to convince someone else of its worth and to sell when its market is trendy.

The advantage of unique assets as investments is that you may enjoy collecting and having the items as well as watching their value appreciate. If you are a guitarist, for example, having and being able to play a vintage guitar may mean more to you than the fact that it may be a good investment. For some, collecting becomes a hobby.

The disadvantages of investing in collectibles are:

- high probability of mispricing, as markets are inefficient.

- lack of liquidity (how quickly an asset can be sold for cash).

- lack of earnings, as there are no dividends or interest.

- costs of holding the investment.

Unless you are knowledgeable about your item and its markets (and even if you are), it is common to suffer from mispricing. Collectibles markets are relatively inefficient because trading partners vary widely in their knowledge about pricing. Both buyers and sellers try to persuade each other of an asset’s rarity and value. It is easy to be misled and to make mistakes in this market. You should always try to find comparable items to compare prices. While online sales and auctions of collectibles at sites such as eBay may be fun for hobbyists, they may not always be the best venues for investors. If feasible, you might get a second opinion from an independent appraiser. Knowledge is an important bargaining chip. The more you know, the more likely you are to be satisfied with your investment decision, even if you ultimately walk away from the deal

Keep in mind that unique investments may not be readily saleable, or their markets may be subject to trends and fashions that cause price volatility. These characteristics mean that your investment may ultimately be a source of gain but that you cannot count on it as a source of liquidity. If you have foreseeable liquidity needs, it may not be appropriate to tie up your wealth in autographed baseballs, vintage action figures, or collectible costume jewelry.

There are no dividends or interest paid while you hold collectibles; therefore, if you have income needs, you might be better off with a different investment. There are also other costs to holding collectibles, such as storage, security, maintenance, and insurance. Your investment actually returns a negative net cash flow—it costs you more than it brings in—until you realize its potential gain by selling it.

Collectibles can be a source of joy and a store of wealth, and you may realize a healthy return on your investment. In the meantime, however, they create costs so that your eventual return will have to be large enough to compensate for those costs in order to make them a really worthwhile investment.

Gold (and Silver and Precious Metals)

Historically, gold and silver have been popular investments of individual investors. For thousands of years, gold and silver have been used as a basis for currency value, either minted into coins or used to back currency value. Most currencies used today are not backed by a precious metal but by the productivity and soundness of the economy that issues them. For example, the value of the U.S. dollar is not related to the value of an ounce of gold, but to the value of the U.S. economy.

When economic or political turmoil seems to threaten the health of an economy and hence the value of its currency, some investors choose to invest in gold or silver that seems to retain its value. For that reason, gold or silver has historically been regarded as a hedge against inflation. But is it? View the video below to learn more:

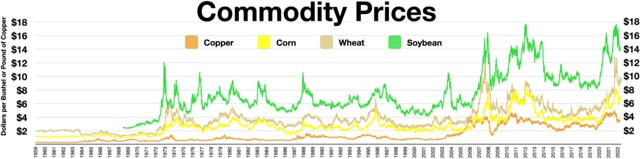

Commodities and Commodity Futures Contracts†

Some investors prefer to invest directly in the raw materials that are critical to an industry or market, rather than investing in the companies that use them by buying stock or bonds issued by those companies.

Commodities are raw materials — agricultural products, metals, energy sources, and so on — that go into producing goods and services. Because commodities are–or rely on–natural resources, they have a largely unpredictable supply. They have inherent risk, because they are exposed to changes in weather or geology or global politics. Commodities trading is not new; the first commodities exchange in the United States was established in 1848.

But not everyone has the facilities to buy and store commodities in the amounts that they trade in – for example, tons of sugar or tens of thousands of pounds of cotton. Another way people and companies can invest in commodities is through a derivative known as a futures contract. A futures contract is a commitment to deliver a certain amount of a specified item at a specified date in the future. A futures contract buyer and a futures contract seller specify a commodity to be delivered and paid for when the contract matures. The futures price is guaranteed by the contract.

Producers of commodities use futures contracts extensively. For example, a wheat farmer in Iowa plants 1,000 acres of wheat in April. She knows that if all goes well, come September, she will have 500,000 bushels of wheat. September wheat futures are currently selling ‒ in April! ‒ for $6 per bushel. Our farmer can “sell” her wheat via a wheat futures contract while it is still germinating in the ground. She can guarantee a price that she is happy with and will result in a profit for her. The contract states she will deliver the wheat in September and receive $6 per bushel no matter what happens to wheat prices.

Companies that use commodities in their products also use futures contracts. For example, cereal companies such as Kellogg’s, General Mills, and Post need tons and tons of wheat each year to make cereal and other foodstuffs. As an example, companies can use futures contracts in April to purchase the wheat to be delivered in September and pay $6 per bushel, no matter what happens to wheat prices between April and September. In this way, we can think of futures contracts as insurance. The farmer and the food companies are using futures contracts like insurance to protect themselves — or hedge — against unfavorable changes in the price of wheat, in this case.

What are the disadvantages of using futures contracts when you are the producer and when you are the consumer? If wheat prices plummet, the farmer is protected, yes, but on the other hand, if wheat prices rise substantially, the farmer cannot take advantage of the higher prices since she is already contractually obligated to sell her wheat for $6 per bushel. Likewise, although the food companies are protected against considerable price increases, if prices fell appreciably, they will not be able to take advantage of the lower prices since the food companies have already promised to pay the farmer $6 per bushel, no matter what happens to wheat prices.

Can anyone buy futures contracts? One does not have to be a commodities producer or consumer like the farmer or cereal companies in order to buy and sell futures contracts. One can can be a speculator. Speculators buy and sell the futures contracts without owning or taking delivery of the commodity. A speculator can buy a contract for 500,000 bushels of wheat to be delivered in September even if they live in an apartment in Astoria and have never seen a farm! Speculating with futures contracts is accepting the futures price risk without owning the underlying commodity. Speculation is the opposite of hedging.

Futures speculation depends on accurately forecasting the direction of commodity price movements in the future. Can anyone accurately forecast the future? If our Astoria speculator sitting in her condo had purchased the futures contract for 500,000 bushels of wheat to be delivered in September, and wheat prices plummeted, they could potentially lose hundreds of thousands of dollars!

Investments in commodity futures contracts can be risky business. When you invest in derivatives like these, you are taking on the risk of both the contract and the asset that it depends on. Commodities investing is risky for individual investors because professional commodity investors often take speculative positions, betting on the future price of derivatives without holding investments in the underlying commodities. In this way, speculators can influence that future price, which, after all, is just the market’s consensus of what that price “should” be. For individual investors, the risks of commodities trading often outweigh the advantage of whatever diversification they bring to the portfolio. The Commodity Futures Trading Commission (CFTC) offers effective information and tools to help consumers avoid fraud, including checking that people and firms that solicit you to trade are registered with CFTC.

Futures contracts are financial instruments that actually have a valid reason for existence and are very important to our global economy for large-scale producers and users of commodities. However, for the vast majority of investors, they are extremely risky and dangerous and can turn an otherwise prudent, long-term investment portfolio into a pool of tears overnight. Remember, you are learning about these derivatives so that you will be protected against their siren calls of “get rich quick.”

* This chapter was adapted in part from chapter 17 of the book Individual Finance by R.S. Siegel and C. Yacht [fixed] under a Creative Commons CC BY-NC-SA 3.0 license, unless otherwise indicated (Investing, 2012).

** This section was adapted from Bitcoin pros and cons [PowerPoint slides] created by Next Gen Personal Finance under a Creative Commons CC BY-NC 3.0 Unported License (Bitcoin, n.d.), unless otherwise indicated.

*** This section is adapted from chapter 17 of Introduction to Investments by Frank Paiano under a Creative Commons CC BY-NC-SA 4.0 license, unless otherwise indicated.

† This section is adapted from chapter 13 of Introduction to Investments by Frank Paiano under a Creative Commons CC BY-NC-SA 4.0 license, unless otherwise indicated.

Test Your Knowledge

Please Provide Feedback

What is one tip that you learned from this chapter?

References

Cointelegraph. (2024, October 31). Witch hunt: Unmasking the top 10 crypto scammers and their tactics. https://cointelegraph.com/learn/ articles/unmasking-the-top-10-crypto-scammers

Crypto Literacy. (2025). Crypto literacy quiz. https://cryptoliteracy.org/quiz/

Hayes, A. (2023, August 25). 10 important cryptocurrencies other than Bitcoin. Investopedia. https://www.investopedia.com/tech/most-important-cryptocurrencies-other-than-bitcoin/

Reiff, N. (2024, January 13). Why is Bitcoin volatile? Investopedia. https://www.investopedia.com/articles/investing/052014/why-bitcoins-value-so-volatile.asp

Statista. (2025, January). Number of cryptocurrencies worldwide from 2013 to January 2025. https://www.statista.com/statistics/863917/number-crypto-coins-tokens/

Torpey, K. (2024, December 16). FTX to begin repaying customers in early 2025: What you need to know. Investopedia. https://www.investopedia.com/ftx-to-begin-repaying-customers-in-early-2025-what-you-need-to-know-8762380