2 Why Budget? Budgeting as Spending Plan

Learning Outcomes:

- Learn how to effectively borrow and save over time.

- Explain the concept of price and how it relates to planning a budget.

- Learn how to create a solid financial plan.

- Set effective goals and differentiate goals in terms of timing.

What You Should Know Before You Start A Budget

Saving and Borrowing

- Watch this video:

- Answer these practice questions.

Budget as Spending Plan

Writing Down Your Goals

Figuring out where you want to go is a process of defining goals. You have shorter-term (1–2 years), intermediate (2–10 years), and longer-term goals that are quite realistic and goals that are more wishful. Setting goals is a skill that usually improves with experience. To be useful and practical, goals must be Specific, Measurable, Attainable, Realistic, and Timely (S.M.A.R.T.). Goals change over time, and certainly over a lifetime. Whatever your goals, however, life is complicated and risky, and having a plan and a method to reach your goals increases the odds of doing so.

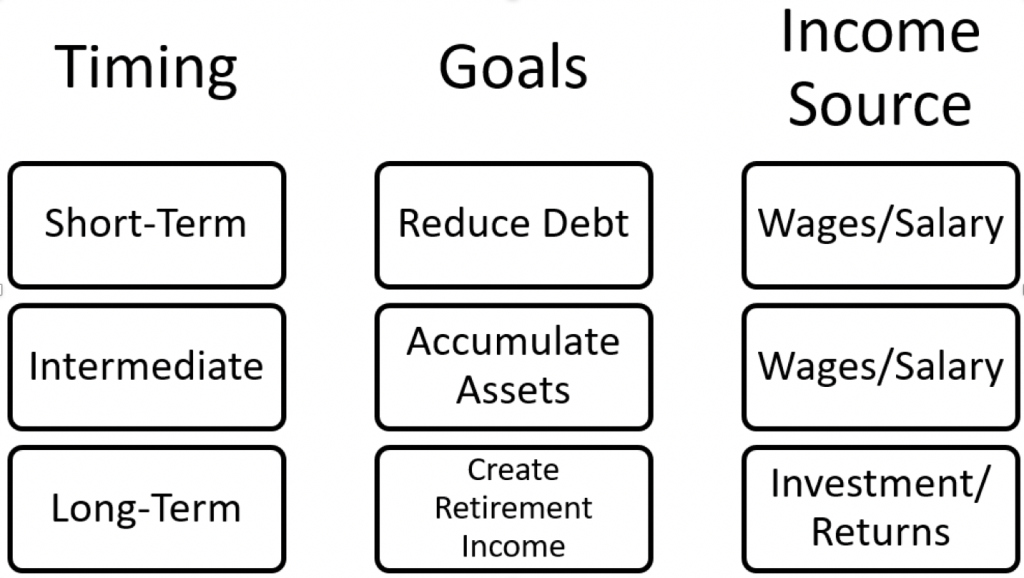

While attending college, you have an immediate focus on earning income to provide for living expenses and debt (student loan) obligations. Within the next decade, you may have a family; if so, you will want to purchase a house and start saving for your children’s education. Your income will have to provide for increased expenses and generate a surplus that can be saved to accumulate these assets. In the long term, you will want to be able to retire and travel, deriving all your income from your accumulated assets. You will have to have accumulated enough assets to provide for your retirement income and for the travel. The table below, “Timing, Goals, and Income Source,” shows the relationship among these elements:

Your income will be used to meet your goals, so it is important for you to understand where your income will come from and how it will help in achieving your goals. You need to assess your current situation.

Assessing the Current Situation

Figuring out where you are or assessing your current situation involves understanding what your present situation is and the choices that it creates. There may be many choices, but you want to identify those that will be most useful in reaching your goals.

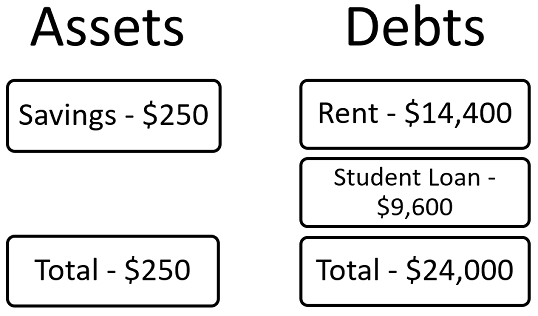

Assessing the current situation is a matter of organizing personal financial information into summaries that can clearly show different and important aspects of financial life—your assets, debts, incomes, and expenses. These numbers are expressed in financial statements—in an income statement, balance sheet, and cash flow statement (topics discussed in the next section “Components of a Spending Plan or Budget”). Businesses also use these three types of statements in their financial planning. For example, your assets may only be a savings account with a balance of $250. Debts may include a student loan with a balance of $9,600 and an apartment rent balance of $1,200. These elements are shown in the “Financial Situation” table below:

Financial Situation

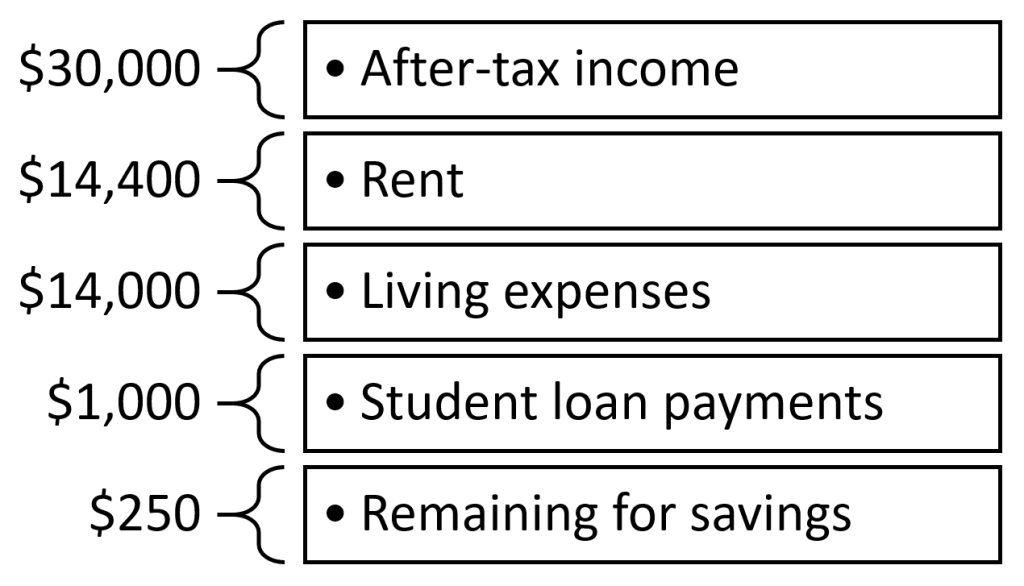

Your annual disposable income (after-tax income or take-home pay) may be $30,000, and annual expenses are expected to be $14,400 for rent and $14,000 for living expenses—food, transportation, entertainment, clothing, and so on. Your annual loan payment is $1,000 for the student loan, as shown in the “Income and Expenses” diagram below:

Income and Expenses

You will have an annual budget surplus of just $600 (income = $30,000 − $29,400 [total expenses + payments]). You will be achieving your short-term goal of reducing debt, but with a small annual budget surplus, it will be difficult for you to begin to achieve your goal of accumulating assets. To reach that intermediate goal, you will have to increase income or decrease expenses to create more of an annual surplus. When your student loans are paid off in about ten years, you will no longer have student loan payments, and that will increase your surplus significantly (by $1,000 per year) and allow you to put that money toward asset accumulation.

Assessing your current situation allows you to see you must delay accumulating assets until you can reduce expenses by reducing debt (and thus your student loan payments). You are now reducing debt, and as you continue to do so, your financial situation will begin to look different, and new choices will be available to you.

(Siegel & Yacht, 2009)

Evaluating Alternatives and Making Choices

Figuring out how to go from here to there is a process of identifying immediate choices and longer-term strategies or series of choices. To do this, you must be realistic and imaginative about your current situation to see the choices it presents and the future choices that current choices may create. The characteristics of your living situation—family structure, age, career choice, health—and the larger context of the economic environment will affect or define the relative value of your choices.

- Watch this video:

- Answer these practice questions.

Budgeting Apps

For budgeting apps, see Financial Technology (FinTech) Products and Banking Arrangements chapter.

- During your prime working years, you will make more than you consume so that you can pay off education debt and save extra income for retirement.

- As interest rates go up, the quantity of savings supplied increases. As interest rates fall, the quantity of borrowing demanded increases.

- An opportunity cost allows you to give up one item in your budget so that you can use that money for another item.

- Goals are shaped by current and expected circumstances, family structure, career, health, and larger economic forces.

- Depending on the factors shaping them, goals may be short-term, intermediate, or long-term.

- Choices will allow faster or slower progress toward goals and may digress or regress from goals; goals can be eliminated.

Please Provide Feedback

References

Siegel, R., & Yacht, C. (2009). Personal finance. Open Textbook Library. https://open.umn.edu/opentextbooks/textbooks/31