How will you pay the tuition for each semester that you are enrolled? Also, how will you pay for other college expenses, such as books, laptop, fees, possibly even trips? What about commuter expenses? What about food? Each student must calculate the cost for each semester and figure out how to pay for college. The following resources can help you estimate your expenses:

CUNY budget estimator page: https://www.cuny.edu/financial-aid/tuition-and-college-costs/comparing-college-costs/

CUNY college cost calculator: https://npc.cuny.edu/npc/public/fin_aid/financial_aid_estimator/FinAidEstimator.jsp

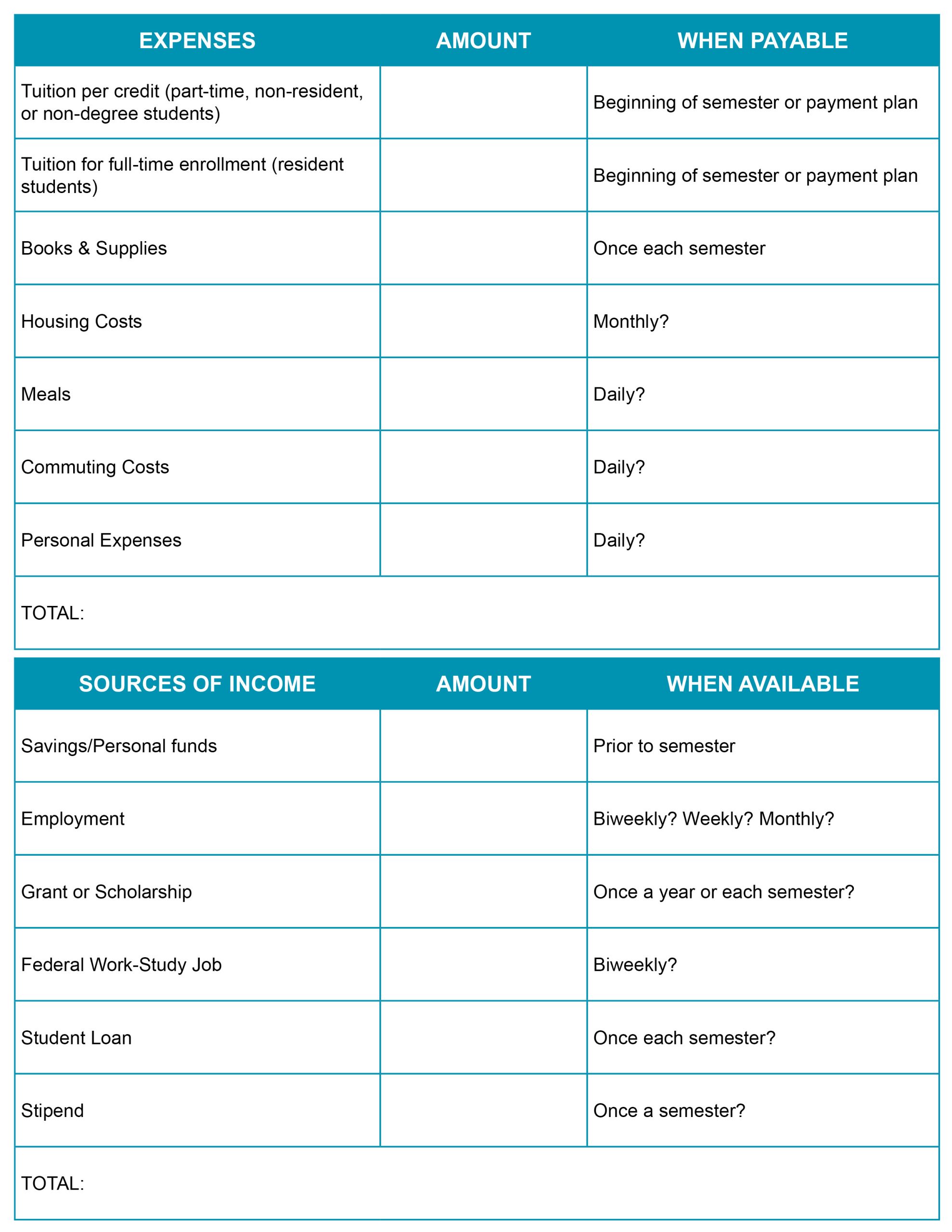

Exercise 1.4: Creating a Budget

Use the charts below to estimate your expenses and available income. Bear in mind the dates when payments are due, which will vary depending on your tuition payment plan, and also pay attention to when your funds will be available. Some scholarships or loans might be paid out annually while others will be paid each semester, and pay dates for work can vary as well.

Click to download a fillable document: Exercise 1.4: Creating A Budget

Residency and Tuition

Because the City University of New York (CUNY) is a public institution of higher education, it is funded by the City of New York, the State of New York, grant funding, and tuition, which includes payments received from students attending any of its 23 campuses. CUNY is known for its low-cost tuition; however, the cost is higher if you are not a resident of New York State.

Students who meet certain criteria, including living in New York State, pay a lower, “resident” rate for each credit-hour compared to students who live outside the State of New York.

When you are admitted to City Tech, you will receive a letter of admission. This letter will state your fee status, which indicates whether you are paying in-state or out-of-state tuition.

Eligibility for the in-state tuition rate has two primary components:

- You must be a U.S. citizen, a permanent resident, or have a qualifying immigration status (see CUNY link below regarding qualifying immigration statuses) AND

- You must have continuously resided in the State of New York for a period of at least twelve (12) consecutive months immediately preceding the first day of classes

Certain non-residents, including undocumented or out-of-status students, are eligible for the in-state tuition rate based on their attendance and graduation from a New York State high school or receipt of a GED or TASC in the state of New York.

For more information on how to request the in-state tuition rate, the appeals procedure available to students who have been denied New York Residency status, and other information, refer to CUNY’s rules and procedures:

City Tech Information on Residency

Frequently Asked Questions: https://www.citytech.cuny.edu/residency/faq.aspx

Checklist for residency requirements: https://www.citytech.cuny.edu/residency/docs/residency_checklist.pdf

Paying Your Tuition

| BURSAR’S OFFICE |

| Namm Hall, NG06 |

| bursar@citytech.cuny.edu |

Visit the Bursar’s Office in-person or online for information about tuition payment dates, acceptable payment methods, and any other questions regarding payments to or from the college.

The Nelnet Tuition Payment Plan enables students to pay their tuition in installments throughout the semester. For payment information, enrollment dates and/or questions, visit: MyCollegePaymentPlan.com or call 1-888-470-6014.

Financial Aid

| FINANCIAL AID OFFICE |

| Namm Hall, NG13 | 718-260-5700 |

| Financialaid@citytech.cuny.edu |

| http://www.citytech.cuny.edu/financial-aid/ |

The Financial Aid Office has information and assistance available for students unsure of their eligibility for loans and awards. Financial aid counselors can also assist you with questions related to your financial aid package and how it may be impacted by your academic choices, such as withdrawing from a class.

There are many types of student aid in the form of grants, work-study programs, and loans.

All students should begin the financial aid process by filing the FAFSA, the Free Application for Federal Student Aid: https://studentaid.gov

Scholarships

| THE OFFICE OF SCHOLARSHIPS & RESIDENCY SERVICES |

| Namm Hall, NG09 | 718-260-5054 |

| ScholarshipSvcs@citytech.cuny.edu |

| http://www.citytech.cuny.edu/scholarships/ |

The Office of Scholarships & Residency Services (OS&RS) helps students navigate the numerous scholarships available and encourages them to apply. Scholarship eligibility is determined upon entrance into the college based on academic strengths and financial need, and monitored throughout each student’s career at the college.

A high GPA is a threshold requirement for many scholarships. To be competitive for scholarships and other special opportunities, work toward a GPA that is 3.5 or higher. Many scholarship applications require essays and other materials submitted by a strict deadline.

Students in programs such as CUNY Edge, SEEK, and ASAP may also contact their program advisor for scholarship assistance.

| EXCELSIOR SCHOLARSHIP PROGRAM |

| https://www.hesc.ny.gov/pay-for-college/financial-aid/types-of-financial-aid/nys-grants-scholarships-awards/the-excelsior-scholarship.html |

The Excelsior Scholarship, in combination with other student financial aid programs, allows students to attend a SUNY or CUNY college tuition-free. Check the website for eligibility requirements and more information.

Understanding the Basics of Loans

Your first priority when applying for and evaluating financial aid opportunities is to take advantage of any grant and scholarship for which you are eligible. Grants and scholarships are money that does not have to be repaid, unless you withdraw early from your academic program or reduce your enrollment status from full to part-time.

Loans, on the other hand, may feel like free money when you receive them, but don’t be fooled! You will eventually need to repay student loans with added interest, which can substantially increase the total cost of college.

That said, many students find that loans are a necessary part of paying for college. If this is the case for you, the best student loan options are usually those offered by the federal government. The first step toward applying for these loans is to file the FAFSA, the Free Application for Federal Student Aid.

Federal Student Loans

There are four types of student loans offered by the U.S. Department of Education. The interest on any of these loans is set at a fixed rate (this means that once you take out the loan, the interest rate will not change), and you do not have to begin repayment until after you leave school. Check here for current interest rates on federal student loans.

Private Student Loans

There are many types of private student loans offered by banks or other financial institutions. Eligibility for these loans is determined by your credit record, not by the FAFSA. You can apply for these loans directly on each lender’s website. Your credit—and your cosigner’s credit—will be evaluated, along with other information provided on your application. Applying for a private student loan with a creditworthy cosigner may increase your chances for approval and may help you get a better rate.

While there are many reliable sources of private loans, some financial institutions are not trustworthy, potentially offering loans with excessively high fees or variable interest rates that may suddenly increase. If you choose to pursue a private student loan, do your research, read the loan terms carefully, and ask for help from the Office of Financial Aid.

You should generally consider federal student loans first, and only take out a private student loan if you still need money for college.

The least desirable means of paying for college costs, credit cards, are discussed below.

Credit Cards and Your Credit History

In our discussion of credit cards, we want to start by emphasizing that you will need to make financial decisions that allow you to graduate with as little debt as possible and establish a good credit record.

We have heard that some students believe that putting all college debts on a credit card is a better option than taking out personal loans because they think they can ultimately file for bankruptcy on a credit card total and have the amount owed erased. Don’t fall for this! Filing for bankruptcy has disastrous effects on your financial situation that last a long time. A record of bankruptcy shows to potential lenders (such as landlords or future employers, as well as financial institutions) that not only are you irresponsible, you are a poor credit risk.

Why is a good credit record important? If you want to apply for a job, rent an apartment, pay utilities, buy a car, or make other major purchases, your credit record will be checked. Housing and financial institutions will look at your credit history to make decisions about your eligibility.

The better and more consistently you show your ability to pay back money that you borrow, the higher your credit score will be. This credit score, known as a FICO score, is determined by factors including paying your bills before the due date, never missing a payment, paying off outstanding debt quickly, and having only one or two credit cards. Your credit history is created by any financial transaction you make. These transactions include daily events, such as swiping debit or credit cards, downloading apps or music, or buying a MetroCard, in addition to formal financial events, such as opening a bank account. Each payment you make is reported to one of three credit bureaus (Experian, TransUnion, and Equifax) and together these determine your FICO score.

To start to establish good credit, open a checking account at a bank or a credit union. Both types of institutions offer services and products like ATMs and credit or debit cards. Do your homework! A checking account may be free (often with a minimum required balance) or may charge a monthly maintenance fee. Check other fees as well, such as overdraft fees or fees accrued when you travel internationally. Debit cards will deduct funds directly from your checking account; if the funds are not there, you will be charged a sizeable overdraft fee. Choose a low-cost checking account with features that meet your needs.

Importantly, good credit is created not by how you spend money, but by how you pay back what you borrow. You may be able to acquire a credit card, which allows you to “borrow” funds up to an established credit limit. Credit cards charge an interest rate each month on the amount you have used or “borrowed.” If you do not pay off the full amount you owe when you receive a monthly statement, the interest charged will be added to what you owe (“the principal”). Your monthly payment will increase because of the additional interest even if you have not used the card since the first bill, increasing the principal amount owed. Interest rates sound lower than they are. Credit card companies offer low introductory interest rates to entice new customers. The long-term interest rates are almost always high after a designated period, so make sure you investigate these details.

Pay Attention to Your Spending Habits

While you might have to use credit cards when purchasing books or other school supplies, credit card misuse can jeopardize your financial future. There are many ways to keep your expenses as low as possible.

- Minimize your cell phone expenses. If you don’t use a streaming service or a paid app, discontinue it.

- Use your City Tech ID card to take advantage of student discounts at movie theatres, retailers, museums, and other sites.

- Alcohol, cigarettes, and vaping all cost money in addition to having negative effects on your health. Save money by reducing or avoiding these expensive habits.

- Keep track of how much small expenses add up, such as frequent coffee, snacks, or water. You’d be surprised how much you give to your favorite café or vending machine!

- Maintain a budget: how much money do you have to spend? What are you spending it on?

signs of Financial Trouble with Credit Cards

- You can only pay the minimum due on your credit card each month.

- Each month you fail to pay your credit card balance in full.

- Your credit card balances keep increasing each month.

- You have reached your credit limit.

- You are not aware of the total amount you owe on your credit card.

When you are a student, credit card debt might feel like you aren’t paying at all, but you end up paying more with added interest. Don’t start your career paying off credit card debt!

Student Loans Versus Credit Cards

College students are targets for credit card companies. The credit card company will assess monthly interest charges on expenditures made with the card. To avoid these charges, pay the full amount owed before the statement due date each month. If an outstanding balance (the “principal”) is carried over to the next month, a credit card interest charge based on the Annual Percentage Rate (APR) will be added to the amount due. The APR is a numeric representation of the interest rate, and the monthly amount is calculated proportionally to the APR.

Exercise 1.5: Calculating Credit Card Interest Charges

Here is an example:

| 1 | The APR for your credit card on your recent statement states 19%. |

| 2 | For the month of May, you made $525 in purchases. You paid the minimum amount due of $25 before the statement due date, leaving you with a balance of $500. |

| 3 | By multiplying the APR and the amount owed ($500 x 19% = $500 x .19), you owe $95 in annual interest. |

| 4 | Divide the annual interest by 12 to get the monthly interest. The monthly interest will be $7.92. |

Now it’s your turn to calculate:

1. What is the monthly interest charge if you were to charge a tuition payment of $3,500 on a credit card if your APR is 21% provided that you pay the $25 minimum amount due?

2. If you decide to apply for a Direct Unsubsidized Loan, the interest begins immediately and is accrued during all periods. If the interest rate for the Direct Unsubsidized Loan is 5%, what will be your monthly interest charge for a tuition payment of $3,500?

Click to download a fillable document: Exercise 1.5: Calculating Credit Card Interest Charges

The Office of the Bursar collects all tuition and fee payments. The Bursar accepts in-person payments made by cash, check, or money order. Students can also make payments online by debit and credit card or electronic check through CUNYfirst.